GFFN Newsletter – Advancing nutrition-related investment standards; unlocking climate finance; COP30 priorities for finance, food, trade, and metrics; new Resilient Prosperity Forum to explore food finance questions. ATNi engages in the IFRS/ISSB consultation on amendments to the SASB standards A critical shift toward healthier product portfolios The food industry’s transition towards providing healthier foods for all is essentialContinue reading “Good Food Finance partners shaping climate policy & financial innovation”

Author Archives: Joseph Robertson

Active Value joins Integrated Data Systems Initiative

Active Value is joining the Good Food Finance Network’s Integrated Data Systems Initiative, as part of our work toward multidimensional metrics for food systems finance and value chain management. The IDSI is a 5-year innovation sprint, initiated in May 2023 by the Good Food Finance Network, for the Agriculture Innovation Mission for Climate Summit. The goal isContinue reading “Active Value joins Integrated Data Systems Initiative”

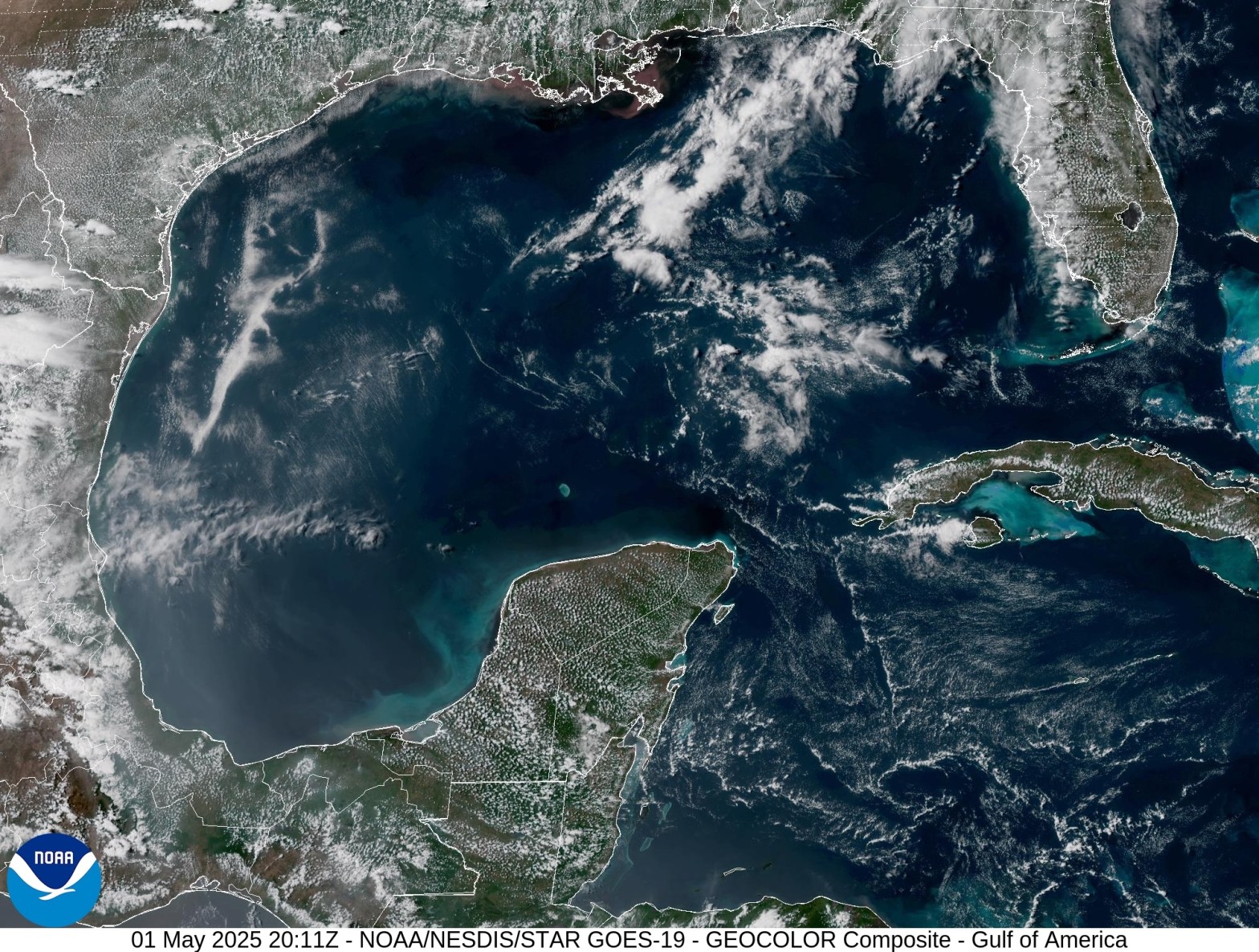

Agrifood transformation can secure a livable climate & ocean future

In its flagship Recipe for a Livable Planet report, the World Bank found that Agrifood is a bigger contributor to climate change than many think. It generates almost a third of GHG emissions, averaging around 16 gigatons annually. This is about one-sixth more than all of the world’s heat and electricity emissions. This has several far-reaching practicalContinue reading “Agrifood transformation can secure a livable climate & ocean future”

City food finance principles to build Climate Value

Cities are increasingly important in the work of shaping human access to health and wellbeing. As more of the world’s population moves to cities, decisions that determine whether air and water are clean and safe, and how food is acquired and distributed in local economies, may determine how long people live and how free theyContinue reading “City food finance principles to build Climate Value”

The future of finance is distributed, multiscale, and resilience-building

The future of finance will be less exploitative and better designed to generate sustainable value, inclusively. It will be distributed, multiscale, and resilience-building. We know this, because the raw math shows it must be so. Already the number of catastrophically costly events driven by climate destabilization has proliferated wildly. Most regions are now experiencing multiple overlapping major climateContinue reading “The future of finance is distributed, multiscale, and resilience-building”