Catalyzing Good Food Finance to address COVID, Climate, and Conflict-related risks

25-29 April 2022

In 2022 and 2023, the work of securing future financial resilience and economic return will require catalytic breakthroughs in ‘good food finance’.

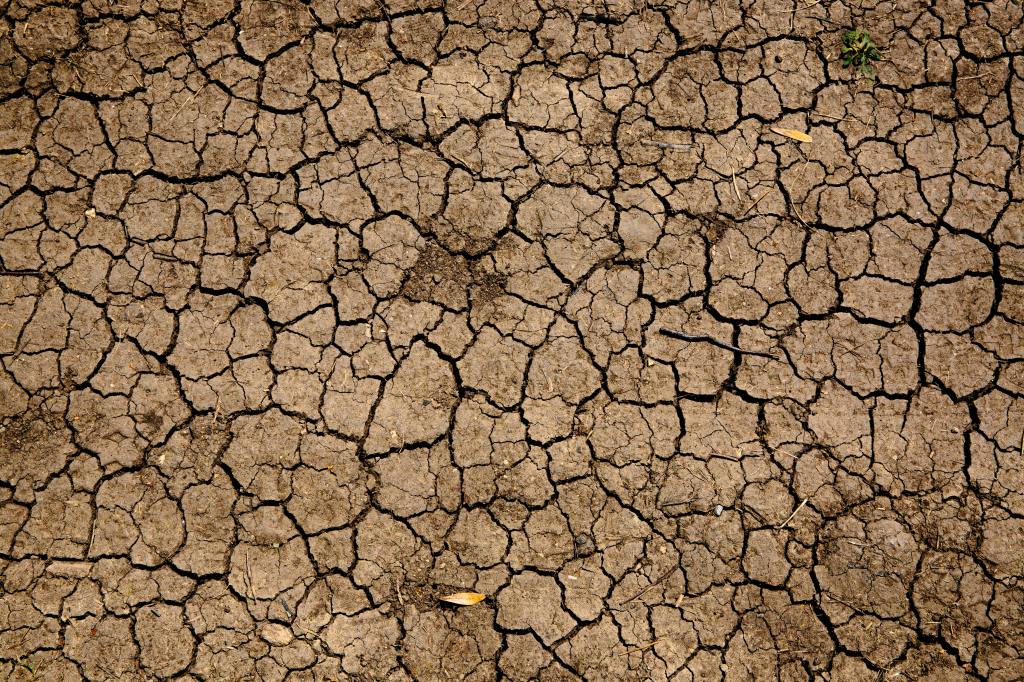

Global food security and long-term financial stability are at risk. Systemic vulnerabilities within global food systems are prevalent, as demonstrated by climate change impacts on global ecosystems and economies, the COVID-19 pandemic, and shock supply disruptions caused by political and military conflicts. Combined with an increasing global population, we cannot avoid persistent climate emergencies without food systems transformation, and the window for climate-resilient development is closing.1 2

25 percent of the world’s food production may become lost due to environmental breakdown by 2050 unless global action is taken.3 Impacts from COVID-19 and conflict related disruptions not only deeply affect agricultural livelihoods but have also led to increasing food prices and shortages of grain exports and key agricultural ingredients.4 5 Failure to achieve climate resilient development is a threat to the stability of the financial system2 , yet the current mainstream perspective of the finance sector does not sufficiently promote the sustainable transformation of food systems.

Thus, the world is now facing an urgent need to rapidly reform global finance and energy systems to support a resilient, equitable, and secure food system and to achieve the Sustainable Development Goals by 2030. The financial sector plays a key role in enabling this transformative shift.

The Good Food Finance Week brings together high-level leaders, financiers and policymakers, technical experts, and other stakeholders to facilitate a discourse promoting investments and proposing financial solutions, or ‘good food finance’, for sustainable food systems.

- The Good Food Finance Week will open with a Leaders Dialogue on Monday, April 25th that is focused on catalyzing good food finance to address COVID, climate, and conflict-related risks.

- The Leaders Dialogue will be followed by five workshops that will launch the first GFFN Catalyst Groups – Catalyst Groups include senior advisors and technical experts working to provide good-practice guidance and innovation to accelerate the implementation of solutions on the ground and work to overcome existing bottlenecks and challenges in financial imperatives related to food systems transformation.

- The week will close with a working meeting of the High Ambition Group – a group of key institutions that demonstrate clear leadership through participation, collective work and experimentation of what can be done to foster the transition to sustainable food systems through finance.

Overview Agenda

| Event | Date | Time |

| Leaders Dialogue | Monday, 25 April | 14:00-16:00 CEST |

| Public Finance Catalyst Group Workshop | Tuesday, 26 April | 16:00-17:30 CEST |

| Investors Catalyst Group Workshop | Tuesday, 26 April | 14:00-15:30 CEST |

| Data Systems Catalyst Group Workshop | Wednesday, 27 April | 14:00-15:30 CEST |

| Incentives and De-Risking Catalyst Group Workshop | Thursday, 28 April | 13:00-14:30 CEST |

| Targets and Metrics Catalyst Group Workshop | Thursday, 28 April | 15:00-16:30 CEST |

| High Ambition Group – Closed Meeting | Friday, 29 April | 14:00-15:15 CEST |

| High Ambition Group – Open Meeting | Friday, 29 April | 15:30-16:00 CEST |

The substance of meetings during this Good Food Finance Week will be used to inform:

- targets, metrics, and actions toward good food finance, by the High Ambition Group and other first movers;

- the design of a major catalytic fund, intended to support the mobilization of mainstream finance for climate-smart, health-building, sustainable and inclusive food systems.

Leaders Dialogue

Catalyzing Good Food Finance to address COVID, Climate, and Conflict-related risks

4.25.22 | 14:00-16:00 CEST

Listen in to the the Leaders Dialogue focused on critical challenges and solutions for catalyzing mainstream capital flows for healthy, sustainable food systems, taking into consideration

- diverse and interacting pressures from the COVID pandemic,

- escalating climate disruption, and

- conflict-related threats to financial and economic stability.

The Dialogue will draw on background materials, such as the Food Finance Architecture launched at the UN Food Systems Summit and the fourteen Actionable Areas of Good Food Finance Innovation, to highlight first mover actions, and key elements of the necessary enabling environment. Leaders participating in the Dialogue will have the opportunity to feed insights from their experience, and their future vision, into workshops held by the GFFN Catalyst Groups, which are now starting to outline emerging opportunities for early action in public finance, private investment, and blended finance, aligned with multifocal targets and metrics, and informed by integrated data systems.

Public Finance Catalyst Group

Panel on Fiscal and Agricultural Support Policies to Address Climate and Food Security

4.26.22 | 16:00-17:30 CEST

This workshop brings together high-level policy experts, governments, academics, and institutional investors to discuss the transition to a more sustainable and resilient agricultural food system from a public finance perspective. The recent crisis in Ukraine has highlighted the vulnerability of our food system to potential shocks. The Ukraine crisis, together with the accelerating impacts of climate change, is likely to drive continued pressure on feed prices and increased risks to food security in both the short- and long-term, creating material risks for investors as well as risking global hunger. The crisis demonstrates the need for a transition to a more resilient and sustainable food system, including through a just transition for farmers with support to accelerate a transition to a more sustainable production system.

Private Investors Catalyst Group

Input Workshop

4.26.22 | 14:00-16:00 CEST

This workshop addresses investment opportunities, evaluates investors interest, risk perception, mismatch (e.g., risk appetite, ticket size, currency), and other risk mitigating measures. Additionally, this workshop will discuss opportunities to link demand and supply for investment, and concrete investment opportunities, including expanding investor base in existing investment vehicles, and country-wide assessment of investment needs and opportunities as linked to matching investors. Sustainable food and agribusiness is a key sector with ample opportunity for investment with both financial and impact returns. Major barriers for private investors, such as risk, lack of knowledge, and political exposure can be overcome through various measures and structures, and there are concrete opportunities available for sustainable investment in (semi-)proven markets and value chain stages.

Data Systems Catalyst Group

Food Systems Business Intelligence: Integrating data systems to secure and build on sustainable returns

4.27.22 | 14:00-15:30 CEST

In order to assess the value of food system transformation for specific products, business models, and investment choices, data systems that manage distinct types of information will need to connect and interact intelligently. This workshop addresses how and why we need integrative, evolving metrics to map progress across many distinct areas of work, including financial returns, ESG, specific planetary health goals, as well as nutrition, food security, and human health. We need to facilitate interaction between datasets and data systems. We need to develop adaptive, evolving secure-flow data system integrations. These systems need to be adaptive enough to bring directional insight into everyday financial decision-making, working with existing financial decision-support platforms.

Incentives and De-risking Catalyst Group

Embedding nature in business practice: the role of public and private sector finance in incentivising sustainable food systems

4.28.22 | 13:00-14:30 CEST

Transitioning agricultural value chains to be more sustainable and resilient is increasingly recognized as critical to addressing climate, biodiversity and inequality challenges, with 95% of countries including the agriculture, land use and forestry sector in their new and updated NDCs. For financial institutions, incentivizing the sustainable business practices needed provides a key opportunity to meet their net zero commitments, yet the complexity of food and land use systems, including often high risks, low returns, long time horizons and highly fragmented finance needs, pose particular challenges for investors. This session introduces GFFN’s Incentives and De-risking Catalyst Group, convened by the World Business Council for Sustainable Development, and brings together investors, financial institutions, companies and other key partners to (1) explore climate and nature related risks in food systems investments, and opportunities to embed climate and nature in financial decision-making as part of a just transition; (2) identify ways in which financial institutions and companies can work together to drive sustainable food systems; (3) consider the role of public sector institutions in de-risking private sector investment in sustainable food systems and identify promising areas for action; and (4) identify partners and focus areas for the Incentives and De-risking Catalyst Group.

Targets and Metrics Catalyst Group

Tracking Progress towards Sustainable Food Systems Finance: Priority areas for action

4.28.22 | 15:00-16:30 CEST

This workshop will introduce the Catalyst Group working on ‘Targets and Metrics’, one of the Good Food Finance Network (GFFN) Actionable Areas of Innovation. The Catalyst Group’s main role is to detail innovation pathways, provide guidance toward better addressing critical financial imperatives related to food systems transformation, accelerate the implementation of solutions, and work to navigate through existing bottlenecks and challenges. The Targets and Metrics Catalyst Group will be a non-competitive space to (a) identify the gaps and barriers and (b) address priorities for action by suggesting metrics and tools to measure progress towards sustainable food systems.

Peer-to-peer exchange on target setting towards sustainable food systems

(Closed meeting)

4.29.22 | 2:00 – 3.15 PM CEST

This meeting for current High Ambition Group members is meant to a) provide general feedback and recommendations in the target setting process (by UNEP) and b) foster a peer-exchange on the process for target setting and on the actual targets being developed by different members in various impact areas.

Driving action towards sustainable food systems by setting targets: Introducing the High Ambition Group

(Open meeting)

4.29.22 | 3:30 – 4:00 PM CEST

This meeting is for financial institutions interested in knowing more about the High Ambition Group. The conditions for joining, the focus and scope of activities will be presented, with examples of concrete actions that financial institutions and businesses can take to support a sustainable food systems transformation. In the days following the meeting, interested institutions can express their interest to join the High Ambition Group.

About GFFN

The Good Food Finance Network is a network of high-level leaders, technical experts and agropreneurs from finance, business and public sector combining their resources and intellectual capital to promote investment and provide finance solutions for sustainable food systems. GFFN drives change in both food systems and finance systems. It is coordinated by EAT, the FAIRR Initiative, Food Systems for the Future, UNEP and WBCSD in collaboration with the World Bank, Rabobank, S2G Ventures, IFAD, OECD, the Global Environment Facility, the World Benchmarking Alliance, Just Rural Transition, the Green Climate Fund, Rockefeller Foundation, the Coalition of Finance Ministers for Climate Action, and others.